|

What to Ask When Shopping for Dental Insurance Quotes

EINSURANCE.comTM

Are you afraid of the dentist? About 30% of people are. But taking good care of your teeth and gums is an important part of your overall health. The good news is there are new procedures that make dental care less physically painful, while dental insurance coverage can take away the financial pain, too.

Here are some things to consider when looking for dental insurance quotes.

- Do you already have a dentist you like? Make sure he or she accepts the dental insurance plans you’re looking at. Just as some health insurance restricts your use of doctors, there are dental insurance plans that specify which dentists you can see. If you really like your dentist, it might be worth paying a slightly higher premium to retain that choice.

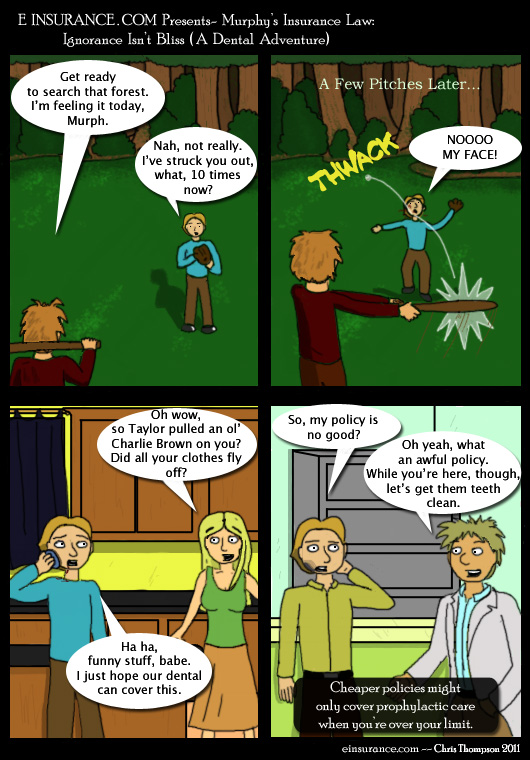

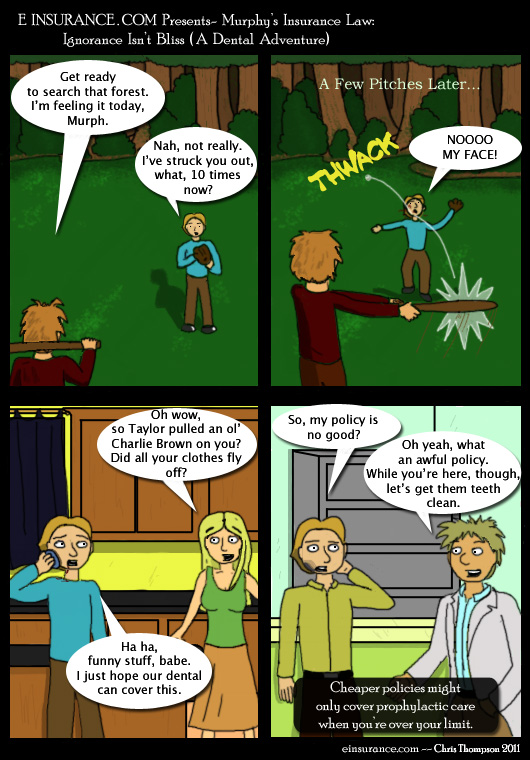

- One of the most important questions is what treatments your dental insurance plan covers. Look for dental insurance quotes for plans that provide 100% coverage for minimum prophylactic care such as at least two cleanings a year, x-rays and fluoride treatments.

- When getting dental insurance quotes, ask whether the plan restricts payment to the cheapest treatment or whether it allows you and your dentist to decide on the best treatment plan. If there are treatment restrictions, ask if you have the option of choosing the more expensive plan and paying the difference.

- Find out if and under what conditions your dental insurance requires preauthorization for treatment.

- Compare the deductibles, co-payments and other out-of-pocket expenses for other routine dental procedures, as well as the maximum allowed plan benefit. Most dental insurance plans are on the calendar year and any unused benefits do not role over into the next year. Conversely, if you use up your maximum benefits in July, you’ll have to pay for any required services through December.

- Understand what the various dental plans you’re looking at consider “usual, customary and reasonable.” UCR in dental insurance lingo means the insurer sets the price for what it will pay for every covered dental procedure. It is rarely based on what your dentist actually charges. In-plan (preferred) dentists agree to charge the UCR.

- Like other health care insurance, your dental premiums and out-of-pocket costs may or may not be tax deductible, depending on your particular situation. Unlike other health care insurance, there is seldom a waiting period to cover pre-existing dental conditions, but if you’re concerned, this is certainly a question to ask when you’re getting competitive dental insurance quotes.

Finally, if you’re among that 30% of folks who are terrified of dentists, ask if the dental insurance coverage extends to sedation. Some of the questions to ask specific to sedation are:

- Whether the plan covers oral, IV or laughing gas sedation

- Whether there are limits on the use of sedation based on the amount of work required and the procedure done

- Whether there are limits of the frequency or duration of sedation

|

|