Life Changing Events That Affect Your Life Insurance Coverage

EINSURANCE.comTM

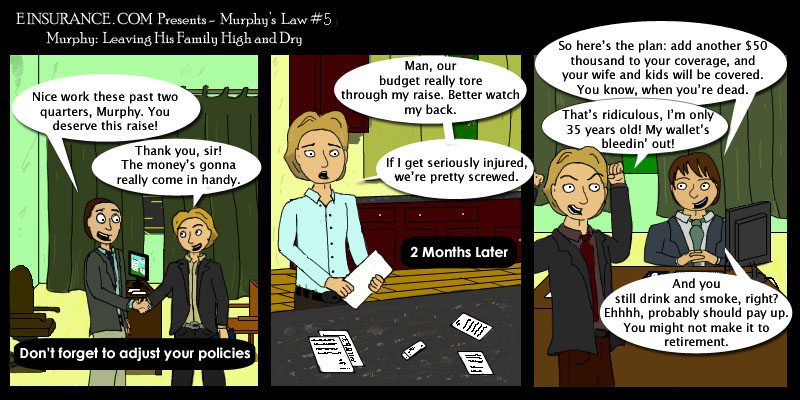

You might think that a life insurance policy is something you purchase and tuck away in a drawer or safe deposit box until it matures or your beneficiaries need it. That would be a very big mistake. Throughout your life, there will be many events that can have a significant impact on your life insurance coverage. At bare minimum, you should review your policy once a year – or more frequently as any of the following occur.

Marrige or Domestic Partnership

There are plenty of reasons why health care costs and health insurance premiums are going up. Here’s what you can do to control them.

Buying a Home or Other Big Ticket PurchaseCould your spouse or partner make the mortgage payments without you? Would he or she have enough to pay property taxes, make necessary repairs, and keep up the homeowner’s insurance policy and all the other expenses that accompany homeownership? The same is true for big ticket purchases like a car, boat, RV or vacation home. It’s time to take another look at your life insurance.

Babies

That bundle of joy is going to need a lot of things over the years, including college. Review your life insurance policy to be sure your surviving spouse or partner can meet those needs if you aren’t around to help.

Changes at Work

If your new job or position included a bump in your income, you’ll probably begin to spend to that level. You and your family will grow accustomed to your new lifestyle. Be sure you have enough life insurance so your survivors won’t have to give it up.

Dependents

Do you have an aging parent or disabled child who depends on you financially? Factor those long-term costs into your life insurance so your dependents are covered in the event of your death.

Widowed or Divorced

Everything changes when you suddenly find yourself single again. Depending on your circumstances, you may no longer need life insurance. Or you may want to keep your policy but designate another beneficiary.